Our We Buy Houses In New York City Ideas

Wiki Article

Examine This Report on We Buy Houses For Cash New York City

Table of ContentsWe Buy Houses In New York City for DummiesThe Of We Buy Houses In New York CitySome Known Factual Statements About We Buy Houses New York City Some Known Facts About New York Home Buyers.

If the debtor later struggles to make repayments on the home loan, the VA can bargain with the loan provider on the individual's part. Particular loan providers give newbie homebuyers with benefits that are sponsored by the government - http://connect.releasewire.com/company/simply-sold-re-332631.htm. For example, new buyers with reduced- to moderate-income degrees may get grants or finances that do not call for settlement as long as the debtor remains in the home for a certain period of time.5 years old. The acquisition does not require to be a traditional home for the specific to qualify as a new property buyer, however it needs to be the person's primary house.

For married couples, the limitation applies individually to every spouse. This indicates that the consolidated limit for a couple is $20,000. The meaning of a newbie property buyer is not as simple as it seems. Federal Real estate and Urban Advancement company programs define a new property buyer as a person that hasn't had a home for three years before the purchase of a house.

5%. A 10% or 20% money down repayment is a formidable challenge, particularly for newbie homebuyers that do not have any kind of home equity. Home mortgages were offered just to the most deep-pocketed customers and were restricted to about half of the residential or commercial property's value.

Indicators on We Buy Houses New York City You Should Know

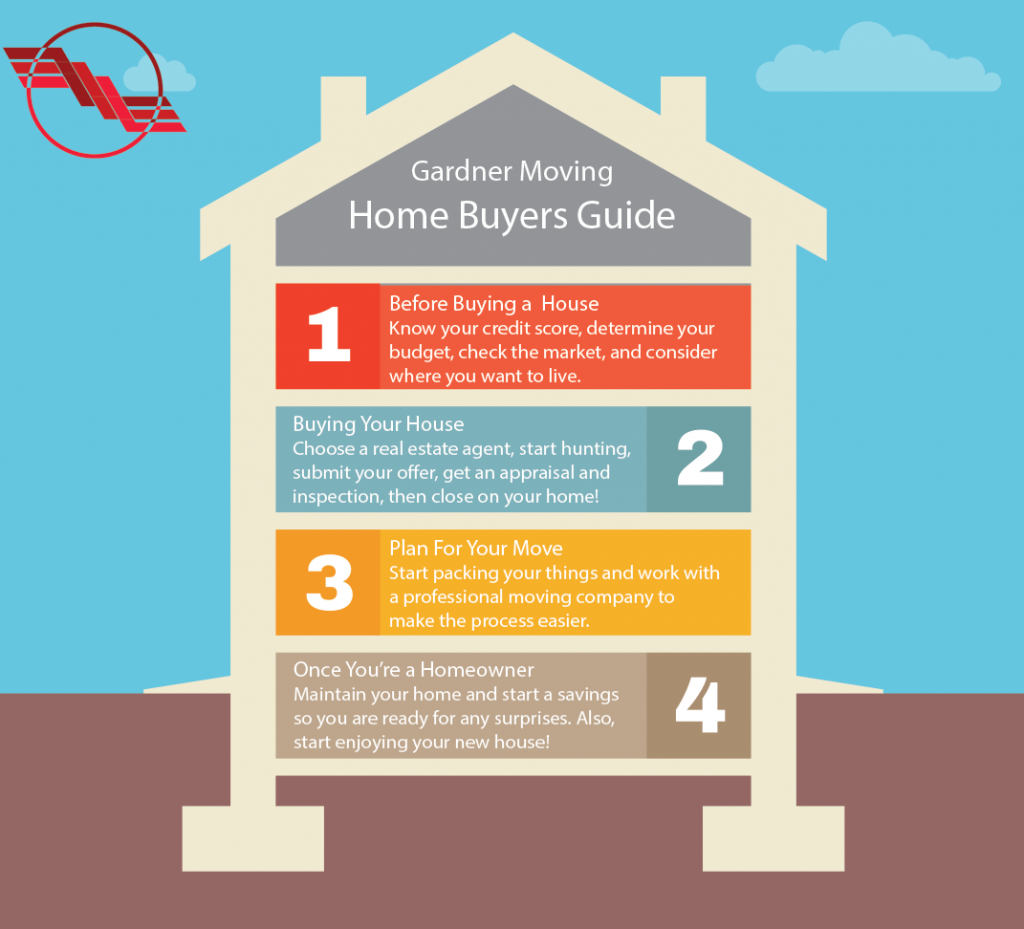

Having finished from university a few years ago, I really did not think it was possible to get a home with my exceptional student financings. Virginia Housing made it feasible with a grant. I couldn't believe these were offered to first-time property buyers without settlement."The following is a table of contents for the Home Customers Handbook. Needs and Wants Checklist Discrimination and Fair Loaning See Open Houses Numerous Listing Solution (MLS) For Sale by Owner Publications Shopping the Classifieds The Home Examination Making a Deal Understanding the Purchase Agreement Settlement Where Do You Discover a Lending institution? Resources for Low-Income Purchasers Will You Required Home Mortgage Insurance Coverage?

Nevertheless, there are many novice homebuyer gives out there that can aid. Homebuyer grants are made to balance out some or every one of the getting prices for novice customers. Grants are often funded federally, however you'll locate them through your state or regional district. A lot of gives have details needs for the kind of buyer and home.

Property buyer grants are created to counter a few of the purchasing expenses for novice customers. They usually cover component of a down repayment, closing prices, or in some cases, also the complete purchase rate of the home. They don't require payment, as long as you live in your home for a needed period of time.

We Buy Houses New York City Fundamentals Explained

federal government doesn't use them straight. Rather, these funds are passed on to private states, areas, and towns, which then create grant programs for residents within their jurisdictions. You have numerous options if you're having a hard time to conserve up for a deposit, or if you're wanting to lower the expenses of buying a home.

There are some important details of the NHF grant: You should use a taking part lending institution to qualify. You must have the ability to utilize it with any lending kind, Federal Housing Management (FHA), Division of Veterans Matters (VA), United State Department of Agriculture (USDA), or conventional. You should live in the home for a minimum of 3 years.

They can vary, depending upon the state in which you buy. You can potentially be required to take a buyer education training course prior to claiming your credit score. If you aren't purchasing for the very first time, you can still be qualified as long as you're buying a residence in a HUD-approved area.

House Buyers New York - Truths

VA and USDA lendings are home loan programs, not assistance programs, however both can help you stay clear of requiring a costly deposit. You'll pay a 2% guarantee charge with a USDA loan, but it can be rolled into your loan and spread across your monthly home loan settlements. VA lendings are used only to armed forces members and professionals.

Various give programs have different eligibility and application demands. It aids to begin by contacting your state agency for real estate grants, which can attach you with local give firms that can assist you with the application process (house buyers new york). From there, you can submit needed applications and submit your financial and history information to establish if you qualify

You may need to satisfy specific look at here now continuous needs to get approved for your give, but payment isn't among them. Many gives only fund a portion of your home acquisition, so you will possibly still need a lending even if you get a grant.

Report this wiki page